jersey city property tax calculator

If you buy 50 or more of the total issued share capital in a company which owns domestic based on rates but broadly equates to residential property immovable property in Jersey or a contract lease of immovable property you must pay Enveloped Property Tax EPTT if the market value of the. General Property Tax Information.

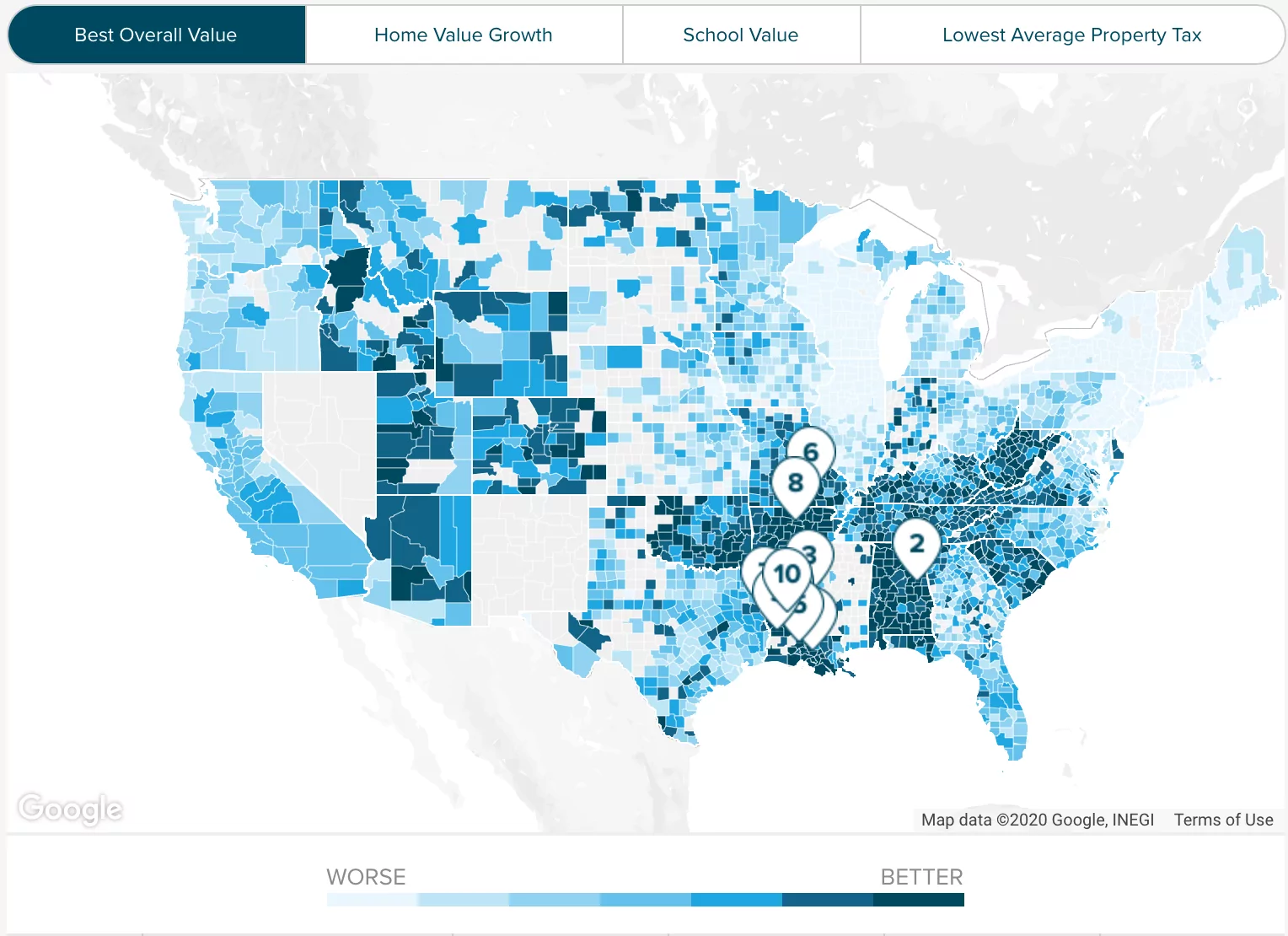

New York Property Tax Calculator 2020 Empire Center For Public Policy

Online Inquiry Payment.

. This is the total of state county and city sales tax rates. If you live in Jersey and need help upgrading call the States of Jersey web team on 440099. 11 rows City of Jersey City.

RTF-1 EE Affidavit of Consideration for Use by Buyers. Jersey City establishes tax levies all within the states statutory rules. City of Jersey City PO.

See Results in Minutes. The median property tax on a 29410000 house is 555849 in New Jersey. Get driving directions to this office.

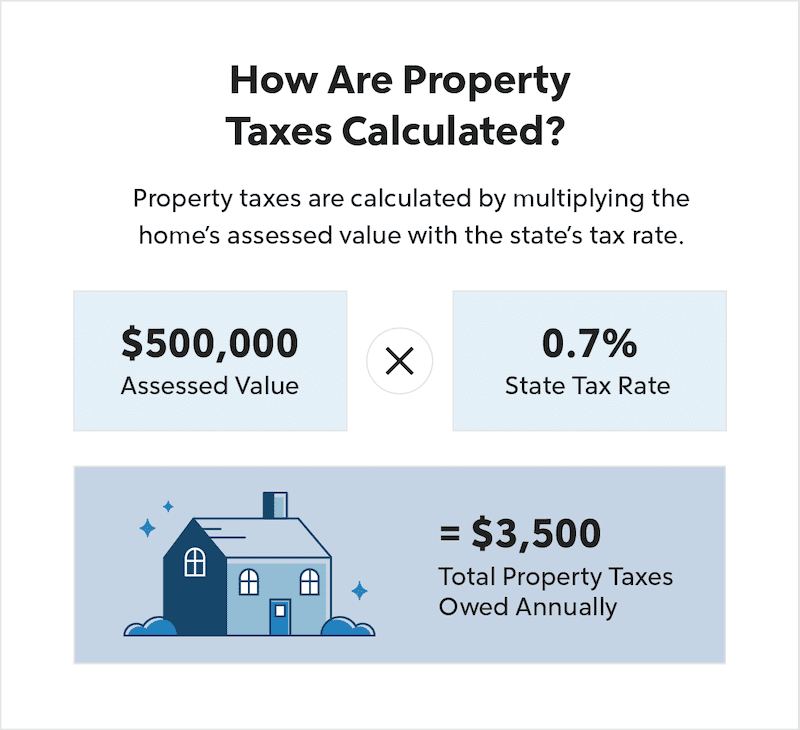

All real property is assessed according to the same standard of value except for qualified agricultural or horticultural land. New Jersey Transfer Tax. For comparison the median home value in New Jersey is 34830000.

Follow these simple steps to calculate your salary after tax in Jersey using the Jersey Salary Calculator 2022 which is updated with the 202223 tax tables. Property Tax Calculator - Estimate Any Homes Property Tax. Left to the county however are appraising property issuing levies making collections enforcing compliance and resolving disagreements.

The standard measure of property value is true value or market value that is what a willing. Select Advanced and enter your age to alter age. Enter Your Salary and the Jersey Salary Calculator will automatically produce a salary after tax illustration for you simple.

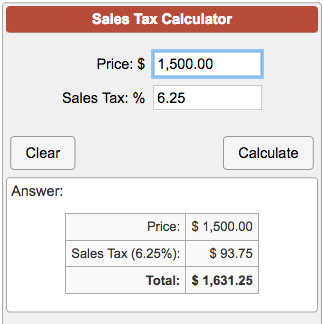

New Jerseys real property tax is an ad valorem tax or a tax according to value. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Box 2025 Jersey City NJ 07303.

201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey. Purchase Price Purchase Price is the only field required. Revenue Jersey PO Box 56 St Helier Jersey JE4 8PF.

Did South Dakota v. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. RTF-1 Affidavit of Consideration for Use by Sellers.

Enveloped Property Tax Calculator. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact your county or citys. The County sales tax rate is.

Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. The New Jersey sales tax rate is currently. GIT REP-1 Nonresident Sellers Tax Declaration.

189 of home value. New Jersey has a 6625 statewide sales tax rate but also has 312 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0003 on. Revenue Jersey Taxes Office postal address.

The Jersey City sales tax rate is. Ad Property Taxes Info. Tax amount varies by county.

In Person - The Tax Collectors office is open 830 am. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. For comparison the median home value in New Jersey is.

Below 100 means cheaper than the. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. This calculator can only provide you with a rough estimate of your tax liabilities based on the.

GIT REP-2 Nonresident Sellers Tax. The median property tax on a 29410000 house is 308805 in the United. The median property tax on a 29410000 house is 432327 in Ocean County.

Use this calculator to estimate your NJ property tax bill. Jersey City New Jersey 07302. The median property tax on a 29410000 house is 308805 in the United States.

The minimum combined 2022 sales tax rate for Jersey City New Jersey is. The average effective property tax rate in New Jersey is 242 compared to. By Mail - Check or money order to.

Useful Transfer Tax Links. Real estate evaluations are undertaken by the county. Enter Any Address Receive a Comprehensive Property Report.

Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

What You Should Know About Contra Costa County Transfer Tax

Township Of Nutley New Jersey Property Tax Calculator

Property Tax How To Calculate Local Considerations

King County Wa Property Tax Calculator Smartasset

Pennsylvania Sales Tax Small Business Guide Truic

The Official Website Of The Township Of North Bergen Nj Tax Collector

Llc Tax Calculator Definitive Small Business Tax Estimator

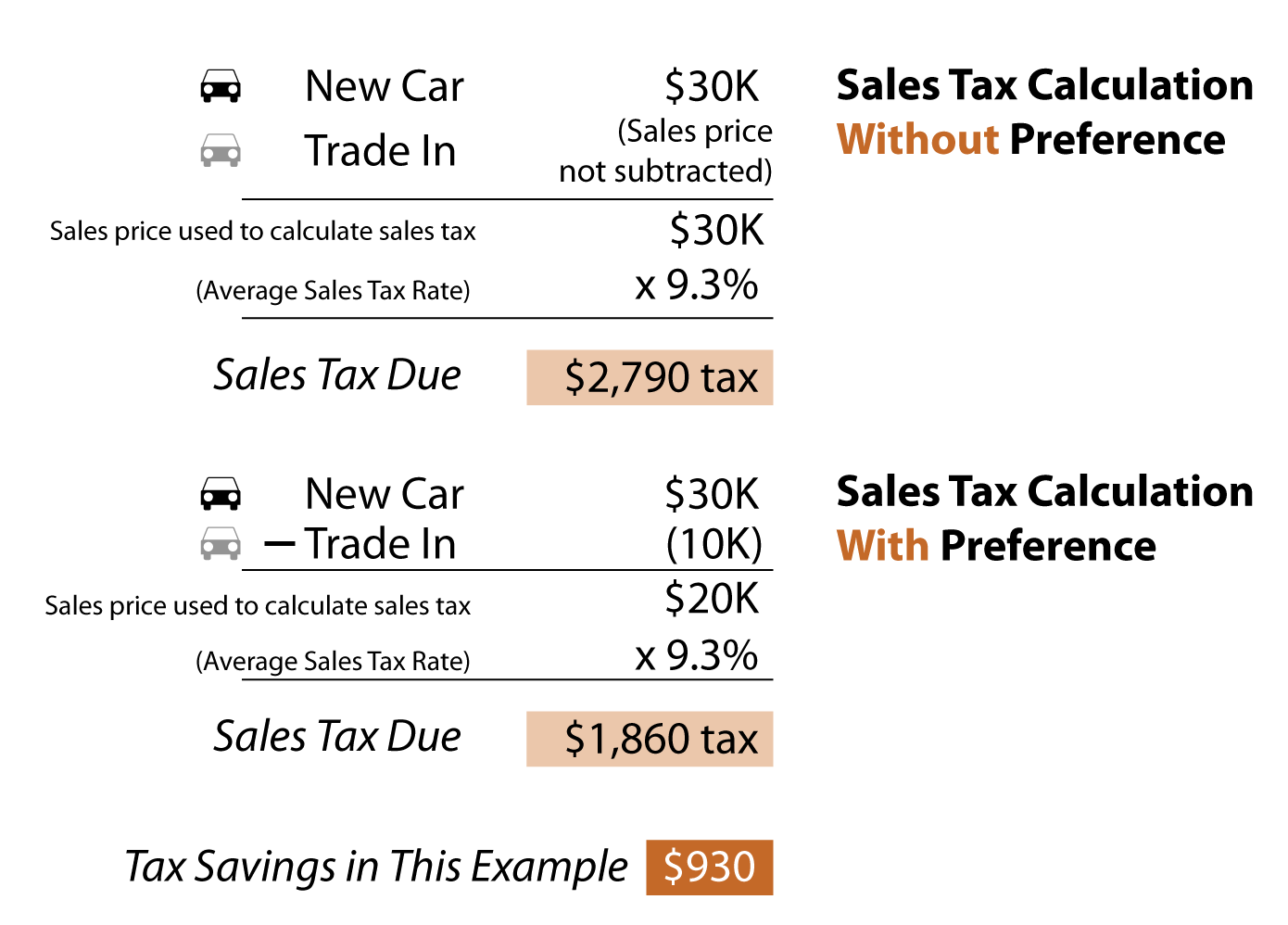

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Real Estate Taxes Vs Property Taxes Quicken Loans

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

New York Property Tax Calculator Smartasset

Riverside County Ca Property Tax Calculator Smartasset

Property Tax Calculator Casaplorer

New Jersey 2021 Property Tax Rates And Average Tax Bills For All Counties And Towns

Property Tax Calculator Casaplorer

Nice Property Tax Calculator San Mateo County In 2022 San Mateo County San Mateo Property Tax

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax