nc state sales tax on food

475 Average Sales Tax With Local. The North Carolina NC state sales tax rate is currently 475.

Sales Tax On Grocery Items Taxjar

The transit and other local rates do not apply to qualifying food.

. In the state of North Carolina any gratuities that are distributed to employees are not considered to be taxable. Eleven of the states that exempt groceries from their sales tax base include both candy and soda in their definition of groceries. A 200 local rate of sales or use tax applies to retail sales and purchases for storage use or consumption of qualifying food.

Total General State Local and Transit Rates County Rates Items Subject Only to the General 475 State Rate Local and Transit Rates do not Apply Items Subject to the 7 Combined General Rate Items Subject to a Miscellaneous Rate Sales and Use Taxes Imposed in Addition to the Rates Listed Above Other Information General Sales and Use Tax. Restaurant meals may also have a special sales tax rate. Sales taxes are not charged on services or labor.

077 average effective rate. Average Local State Sales Tax. Retail Sales Retail sales of tangible personal property are subject to the 475 State sales or use tax.

There are a total of 459 local tax jurisdictions across the state collecting an average local tax of 222. Interactive Tax Map Unlimited Use. Clothing Groceries 2 Prepared Food 9 Prescription Drugs EXEMPT OTC Drugs.

Ad Lookup Sales Tax Rates For Free. 697 North Carolina has state sales tax of 475 and allows local governments to collect a local option sales tax of up to 275. Ad Nc State Sales Tax information registration support.

For example here is how much you would pay inclusive of sales tax on a 20000 purchase in the cities with the highest and lowest sales taxes in North Carolina. Treat either candy or soda differently than groceries. 35 rows Sales and Use Tax Rates Effective October 1 2020 Listed below by county are the total 475 State rate plus applicable local rates sales and use tax rates in effect.

Some state tax food but allow a rebate or income tax credit to compensate poor households. What are the tax brackets in North Carolina. NORTH CAROLINA 475 4 NORTH DAKOTA 5 OHIO 575 OKLAHOMA 45.

NC State is not exempt from the prepared food and beverage taxes administered by local counties and municipalities. With local taxes the total sales tax rate is between 6750 and 7500. STATE SALES TAX RATES AND FOOD DRUG EXEMPTIONS As of January 1 2022 5 Includes a statewide 1.

HI ID KS OK and SD. State Sales Tax The North Carolina state legislature levies a 475 percent general sales tax on most retail sales within the state including prepared foods and. In some states items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate.

This tax is administered by the county and is not subject to the exemption. Grocery Food EXEMPT In the state of North Carolina any and all sales of food are considered to be subject to local taxes. The sales tax rate on food is 2.

Select the North Carolina city from the list of popular cities below to see its current sales tax rate. Non-Qualifying Food Dietary Supplements Food Sold Through a Vending machine Prepared Food Certain Bakery Items Soft Drinks Candy. But youd only charge the uniform reduced rate of 2 local tax on the loaf of bread.

Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. Prepared Food is subject to a higher state sales tax then other items. Are meals taxable in North Carolina.

Here are the special category rates for North Carolina. For example Wake County imposes a 1 tax prepared food and beverages. County and local taxes in most areas bring the sales tax rate to 6757 in most counties but some can be as high as 75.

North Carolina has recent rate changes Fri Jan 01 2021. Maximum Possible Sales Tax. Sales taxes are not charged on services or labor.

Many states have special lowered sales tax rates for certain types of staple goods - such as groceries clothing and medicines. Depending on local municipalities the total tax rate can be as high as 75. 21500 for a 20000 purchase Durham NC 75 sales tax in Durham County 21350 for a 20000 purchase Greensboro NC 675 sales tax in Guilford County.

The exemption only applies to sales tax on food purchases. Just enter the five-digit zip code of the location in which the transaction takes place and we will. New State Sales Tax Registration.

Back to North Carolina Sales Tax Handbook Top. The state sales tax rate in North Carolina is 4750. Click here for a larger sales tax map or here for a sales tax table.

Items subject to the general rate are also subject to the 225 local rate of tax that is levied by all counties in North Carolina. Click here for a PDF version of this table. Arizona Georgia Louisiana Massachusetts Michigan Nebraska Nevada New Mexico South Carolina Vermont and Wyoming.

Food sales subject to local taxes. According to North Carolina law youd be required to charge the full Murphy NC sales tax amount of 7 475 NC state rate and 225 Cherokee County rate on the toothbrush and the candy. Twenty-three states and DC.

The NC sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. General Sales and Use Tax Admission Charges Aircraft and Qualified Jet Engines Aviation Gasoline and Jet Fuel Boats Certain Digital Property Dry Cleaners Laundries Apparel and Linen Rental Businesses and Other Similar Businesses Electricity Food Non-Qualifying Food and Prepaid Meal Plans Lease or Rental of Tangible Personal Property. Includes the 050 transit county sales and use tax.

2021 2022 Meal Plan Options Nc State Dining

![]()

Prepared Food Beverage Tax Wake County Government

Exemptions From The North Carolina Sales Tax

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

Building Local Food Economies A Guide For Governments Nc State Extension Publications

2021 Cottage Food Bills Forrager

Is Food Taxable In North Carolina Taxjar

Is Food Taxable In North Carolina Taxjar

States Can Thoughtfully Implement Grocery Tax Reforms To Help Families And Improve Equity Center On Budget And Policy Priorities

Sales Tax Exemption For Farmers Carolina Farm Stewardship Association

Kelly Goes Shopping For Sweet Food Sales Tax Repeal Settles For Gradual Reduction Kansas Reflector

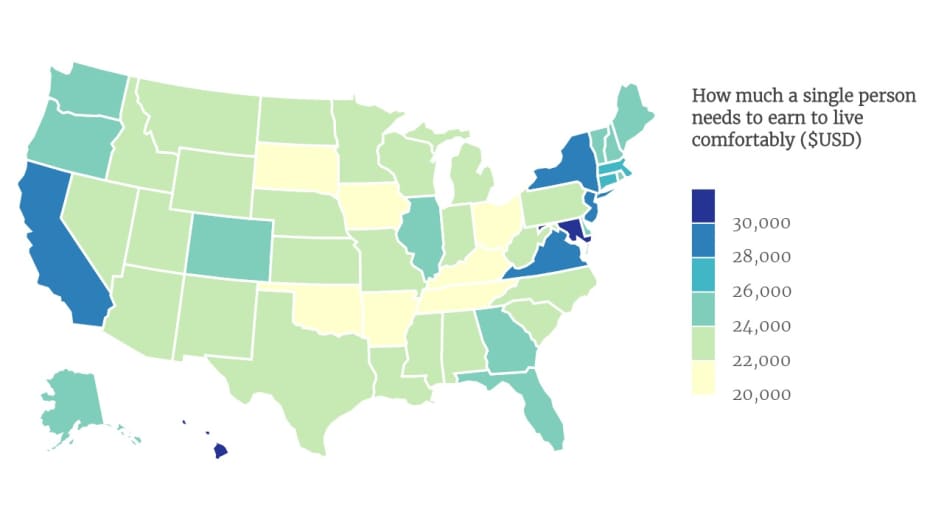

This Map Shows The Living Wage For A Single Person Across America